The parent company of PSA, Collectors, has just announced that it acquired one of PSA’s major competitors: Beckett.

This news comes nearly 2 years after they announced their acquisition of another grading company, SGC. Like it or not, Collectors is gradually flexing the power of PSA to consolidate the grading under one roof, and this isn’t a good thing.

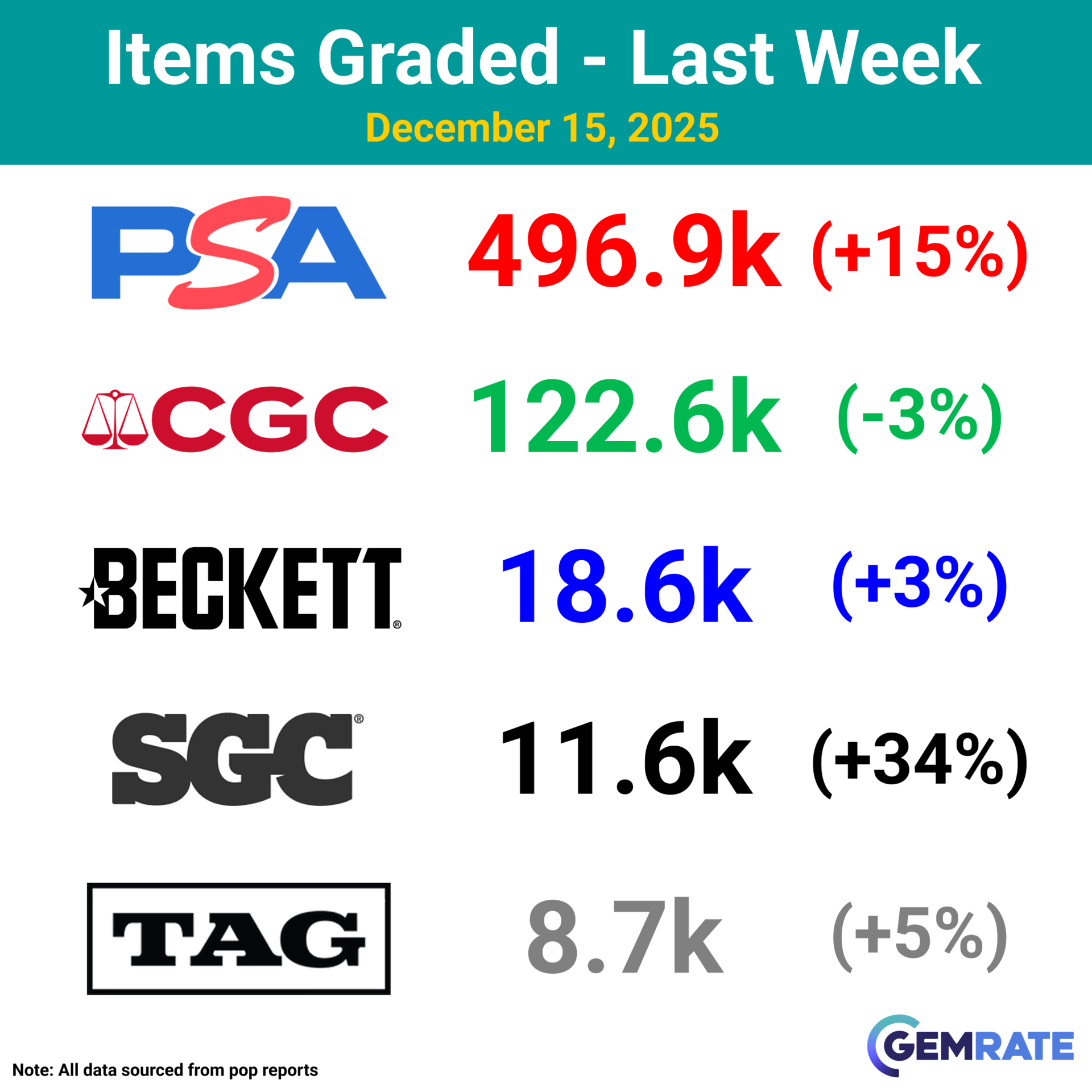

Based on the data collected on Gemrate.com for the past week of grading, the companies owned by Collectors (PSA, Beckett, and SGC) total more than 80% of all cards graded.

Gemrate grading data for the week ended Dec 15, 2025.

And that’s just looking at trading cards…

The scope of Collectors’ businesses is alarming. It includes PCGS (a top coin grader), WATA (video games grader that has now been rolled into PSA), Goldin (collectibles auction house; featured in the King of Collectibles documentary series on Netflix), and CardLadder (a collectibles data analytics platform).

Many of these businesses have played critical roles supporting the growth of collectibles. Grading alone has been massive: it drove massive accessibility by compressing the years of experience collectors used to need to authenticate and evaluate collectibles into a single, easy-to-understand number.

Suddenly, a brand new collector could buy authentic, high-grade cards with zero knowledge or experience: they just needed to trust the grading company.

The problem is, as Collectors grows a larger and larger monopoly, it becomes harder and harder to trust them.

Some cracks are already showing: in the past few weeks, PSA found itself in some controversy over what appears to be fraudulent behaviour from the company.

They were caught grading cards a 9, buying them back from the customer for the market value of a PSA 9 graded card, only to immediately upgrade the card to a 10 so they can resell it at a profit.

To my knowledge, neither PSA nor Collectors has responded to these claims and I cannot verify that they are true, but story highlights an important fact: there’s nothing stopping PSA from doing this.

I find myself falling back to wisdom of Charlie Munger:

Show me the incentive and I’ll show you the outcome.

Collectors’ businesses grew to their prominence by empowering collectors. But, as they’ve grown, they’re now stacking incentives against average collectors. With more power will be more incentive to abuse it, at the expense of collectors.

In the short-term, I don’t expect these issues to materialize. But over the next 10 years, I have my concerns.

I’m still collecting my thoughts on this news, so this is a shorter newsletter this week. Please feel free to reply if you have anything to add, or any counter points you’d like to share. I always appreciate hearing from my readers.

And, as usual,

Thank you so much for reading the TCG Buyers Club newsletter. My name’s Grey, I buy cardboard, and I’m on a mission to make collecting and investing in Pokémon simple.

Cheers 🍻